TPG Insights

Multi-Asset Credit: Your Credit Market GPS

Multi-Asset Credit:

Your Credit Market GPS

Static credit exposures are like maps—useful, but not reactive. In many cases, a map does the job for getting from point A to point B. But it can’t warn you about an upcoming accident, traffic jam, or road closure.

To navigate uncertainty and volatility, investors need a credit market GPS, which is exactly what multi-asset credit provides. Just as a GPS can reroute around traffic jams and roadblocks, effective multi-asset credit strategies enable investors to pivot across credit sectors—public and private, liquid and illiquid—to navigate shifting macro conditions and capitalize on new opportunities as they arise.

A holistic approach to multi-asset credit also expands the investable credit universe beyond increasingly indexed public market exposures while tapping into deals and structures that are otherwise unavailable to most credit investors. In a world where market conditions can shift overnight, static strategies often fall short. By combining real-time adaptability with differentiated sourcing, multi-asset credit helps investors stay agile and stay ahead.

Why Multi-Asset Credit?

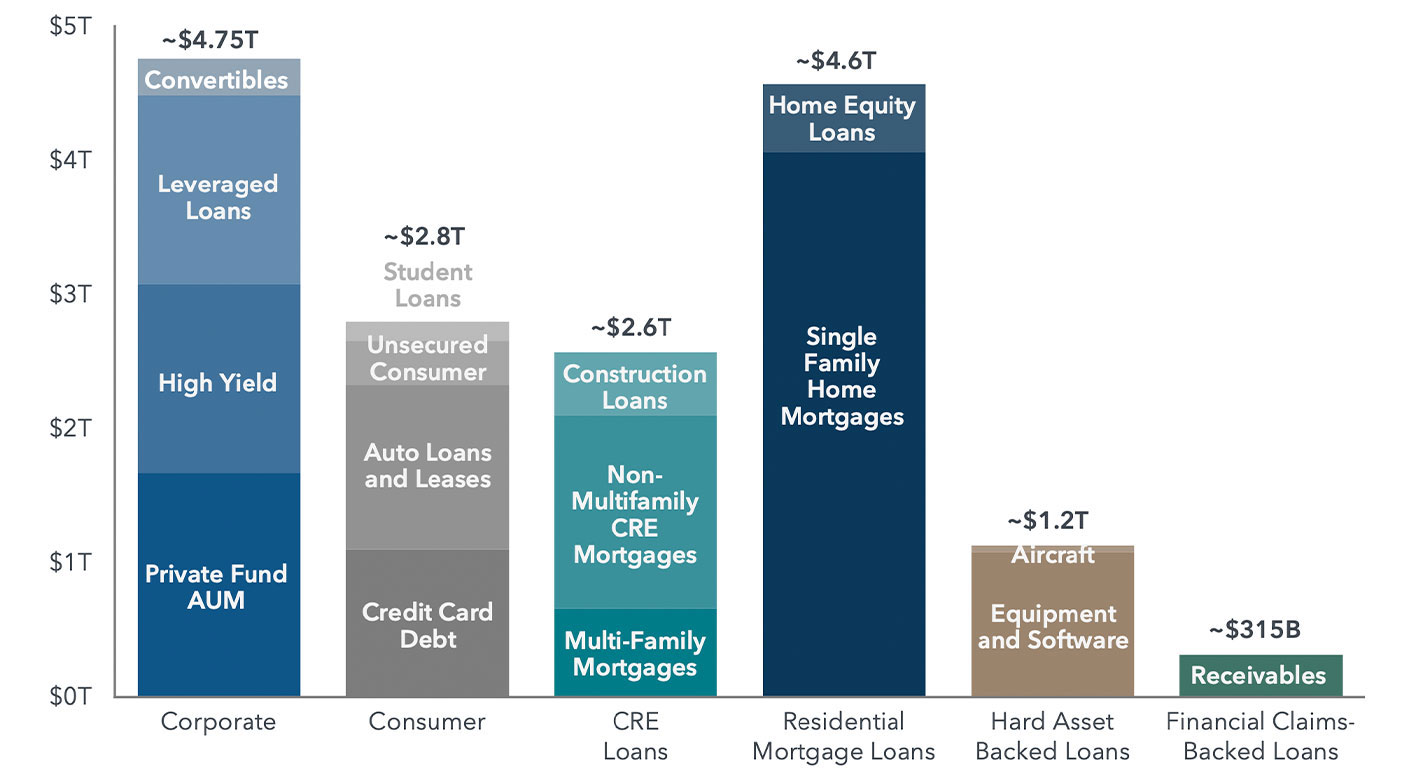

Credit markets encompass a broad and diverse investable universe, spanning over $15 trillion in assets across corporate, real estate, real asset, and consumer exposures (see Exhibit 1).1 It is a landscape far too dynamic to traverse by only following a fixed path.

Exhibit 1: Credit is a Vast and Diverse Investable Universe of Over $15T in Assets

US Corporate and Non-Corporate Credit Markets, $T (excludes US IG corporate credit)2

Note: 1. These figures exclude the >$7T in US IG corporate credit. 2. US Leveraged Loans and HY based on ICE BofA indices. Private fund AUM based on private debt funds tracked by Preqin as of Q3 2024, including direct lending, distressed debt, special situations, mezzanine, and fund of funds, convertible bonds based on market cap of VXA0 as of 5/2025. Source: Bloomberg, Preqin, Goldman Sachs Global Investment Research, TPG.

Navigating credit markets entails choosing among a complex network of routes, each offering different tradeoffs and destinations. Investors must decide between public and private markets, fixed and floating rate exposure, liquid or illiquid assets, and whether to put more weight on relative or absolute valuations when making investment decisions.

They face choices around their seniority in the capital structure, level of downside protection, callable versus non-callable structures, duration, and the balance between yield and credit quality. Each path presents its own risks and rewards, requiring a flexible, time-tested approach to reach the best outcome and one that fits each investor’s unique risk and return objectives.

Just as a GPS relies on both a satellite-level perspective and street-level data, effective credit investing requires combining deep sector insight with a top-down understanding of the macro environment, capital flows, policy shifts and the credit cycle. The vast expanses of the credit market have distinct topographies that demand specialized expertise to assess risk, structure, and value. But this can also be enhanced by an ability to dynamically adjust across credit buckets based on new opportunities or market-wide dislocations.

Across credit markets, investors are able to access a wide range of diversifying risk-reward profiles, each shaped by the structure, sector, and source of the underlying cash flows. From senior secured corporate loans to subordinated real estate debt, from consumer credit to structured credit tranches, each exposure carries its own profile of yield, volatility, liquidity, and downside protection.

Some segments offer steady income with strong collateral, while others provide higher-returning opportunities tied to complexity, illiquidity, or market dislocations. Understanding and unlocking each of these distinct pockets within the credit market is key to building a resilient and opportunity-rich credit portfolio.

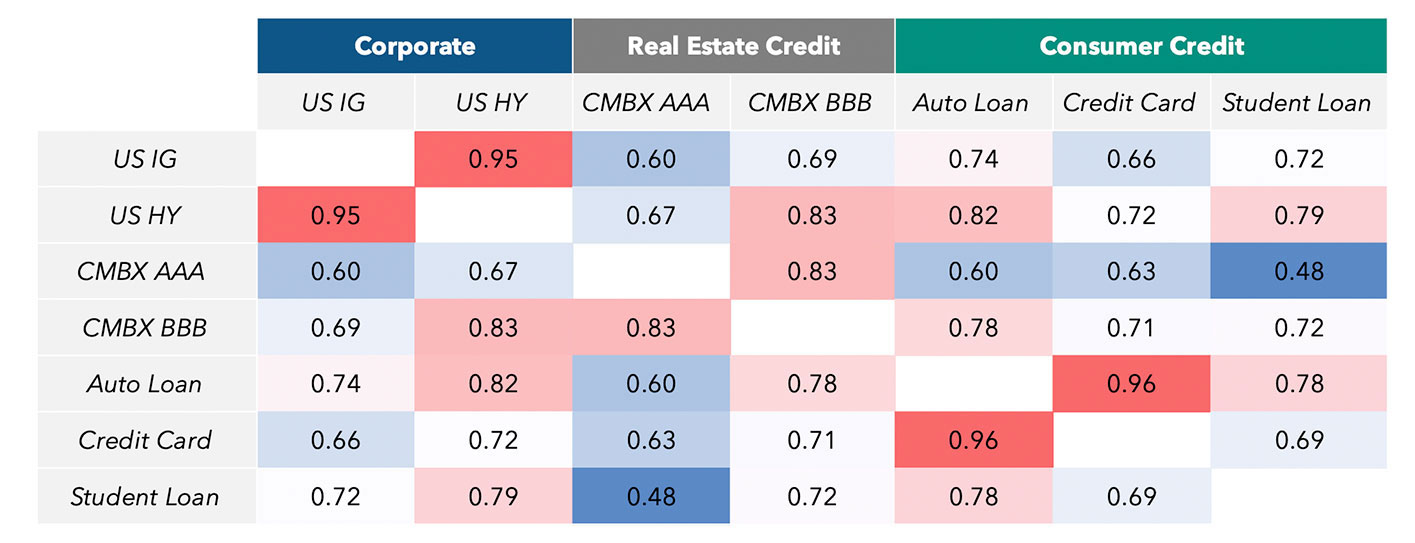

Risk exposures in credit markets are also dynamic, and they shift with market regimes, liquidity conditions, and macroeconomic factors. Multi-asset credit strategies can provide valuable diversification given the lower correlations exhibited across the various sub-segments of credit markets (see Exhibit 2), reflecting their specific economic and market sensitivities.

Exhibit 2: Multi-Asset Credit Provides Valuable Diversification Given Low Correlations Across Credit Types

Note: Correlations are based on asset-level returns between 6/2010 and 6/2025. CMBS based on on-the-run CMBX AAA and CMBX BBB- indices, Auto Loan ABS based on AA-BBB spread, Credit Card ABS based on AA-BBB spread, Student Loan ABS based on AA-BBB spread, and IG and HY based on CDG IG and CDX HY. Past cross-asset correlation relationships don’t necessarily guarantee the same relationships will hold in the future. Source: Bloomberg, Markit, Haver Analytics, ICE-BAML, Goldman Sachs GIR, TPG.

Download the full report hereDisclosures

This white paper is provided for educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The contents hereof should not be construed as investment, legal, tax or other advice.

This white paper, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of TPG Global, LLC (together with its affiliates, “TPG”).

Certain of the information contained herein, particularly in respect of market data, economic and other trends, forecasts and performance data, is from third-party sources. While TPG believes such sources to be reliable, TPG has not undertaken any independent review of such information.

Unless otherwise noted, statements contained in this white paper are based on current expectations, estimates, projections, opinions and beliefs of TPG professionals regarding general market activity, trends and outlook as of the date hereof. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. Neither TPG nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance.

If you believe any content, branding, information or other material incorporated into this white paper has been included in violation of applicable law, agreement, or other restriction, or that any other portion of these materials is otherwise improper, please notify us at compliance@TPG.com.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA