TPG Insights

Secondaries in 2025: The Rise of Single-Asset Specialists

March 2025

Secondaries in 2025: The Rise of Single-Asset Specialists

The private equity secondaries market has evolved from a niche liquidity tool to a distinct pillar of the private equity market. In 2025, secondaries face a dynamic market environment as more conventional exit activity—such as M&A, sponsor-to-sponsor transactions, and even IPOs—is expected to accelerate even as trade war concerns and geopolitical risk are likely to remain persistent sources of volatility.

As the liquidity tide rises across financial markets, we believe single-asset GP-led secondaries will prove to be an all-weather asset class. The rationale is simple—the desire to own your best asset for longer does not depend on the strength of exit markets; it’s driven by the conviction that there is substantial further value in a company and a desire to capture that value rather than hand that upside to a competitor.

We believe single-asset GP-led secondaries specialists will further demonstrate the attractiveness of this fast-growing segment of the market in coming years—however, this will likely also be accompanied by greater dispersion between the performance of built-for-purpose single-asset specialists and generalist secondaries investors. Built-for-purpose single-asset specialists target companies they want to own based on decades of experience in private equity and deep sector expertise.

The Next Phase Of Secondaries:

A Possible Easing Of The Liquidity Imperative

While the last few years were dominated by the liquidity imperative across private equity markets, as a sharp rise in interest rates contributed to falling valuations, reduced exit activity, and a greater emphasis on returning capital to investors, the next few years may see some liquidity relief.

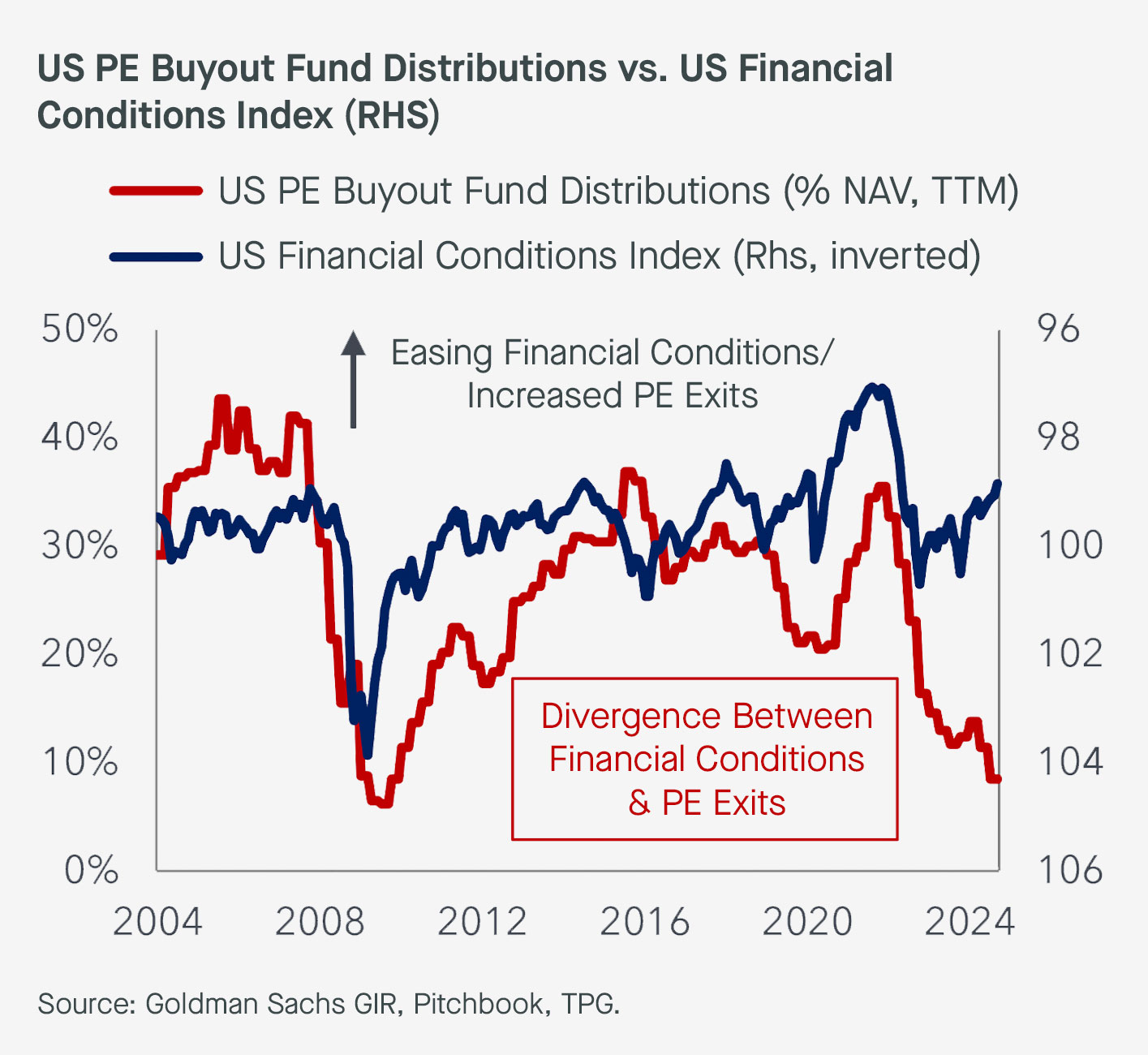

Historically, the volume of private equity exits has closely tracked US financial conditions, which reflect the impact of a variety of factors such as the fed funds rate, changes in US equity values, and credit spreads, among others, on the economy (see Exhibit 1). This close relationship between broader financial conditions and the volume of PE exits is logical given a favorable financing environment should increase investors’ willingness to transact.

Exhibit 1: US PE Exits Have Lagged Despite Easing Financial Conditions, Which Could Change in 2025

However, over the last year, there has been a notable divergence between easing financial conditions and private equity exits. We believe this indicates that a period of stronger PE exit activity may lie ahead. In coming years, the combination of a continued gradual normalization in long-term rates and strong pent-up deal demand could set the stage for a rebound in US private equity exits and help to close this gap.

Single-Asset CVs Have Demonstrated Resilience Across Market Cycles

The rapid growth of the private equity secondaries market in recent years—amid a reduction in overall private equity market liquidity—has increased focus on whether the supply of single-asset continuation vehicle (CV) opportunities could start to slow if the exit environment improves.

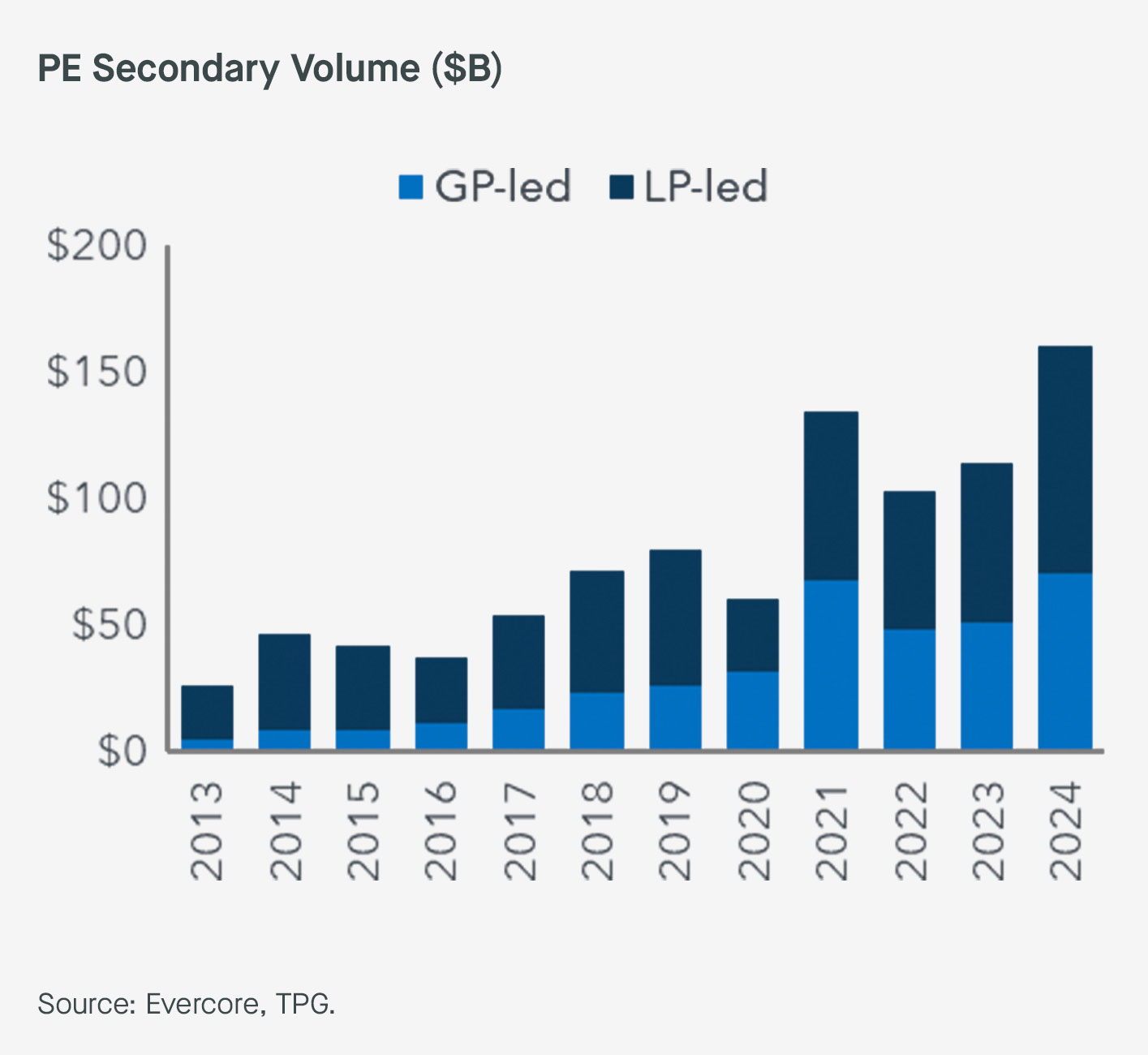

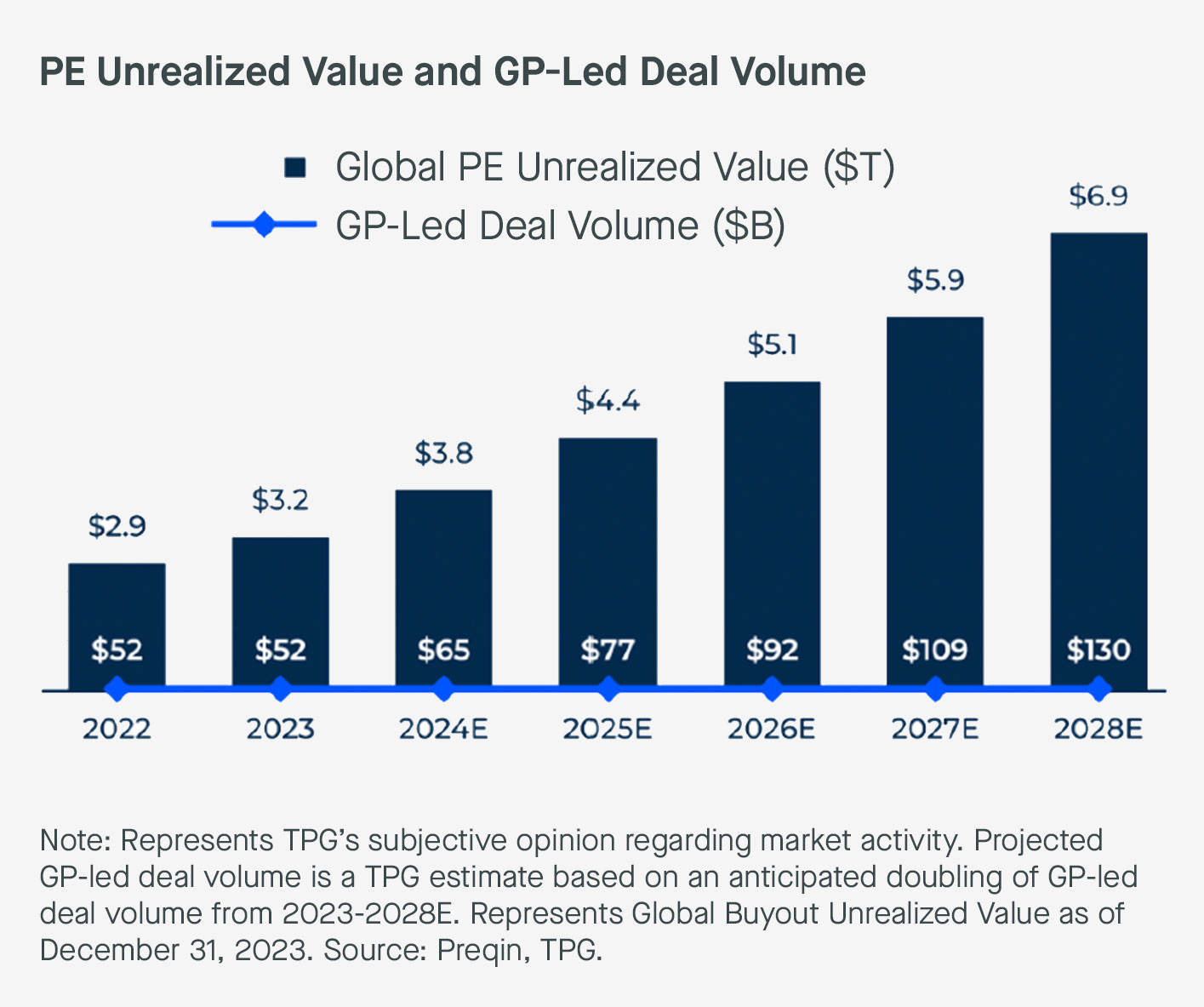

Historical data shows that the growth of the private equity secondaries markets, and GP-led secondaries in particular, has been strong even in environments with record IPO and M&A exit volumes, including from 2018-21 (see Exhibit 2). We believe this is because the main driver of growth in the single-asset GP-led secondaries market is asset owners’ desire to hold onto their highest-performing assets rather than a lack of alternative exit options.

Exhibit 2: GP-Led Secondaries Growth Has Remained Resilient Across Market Environments

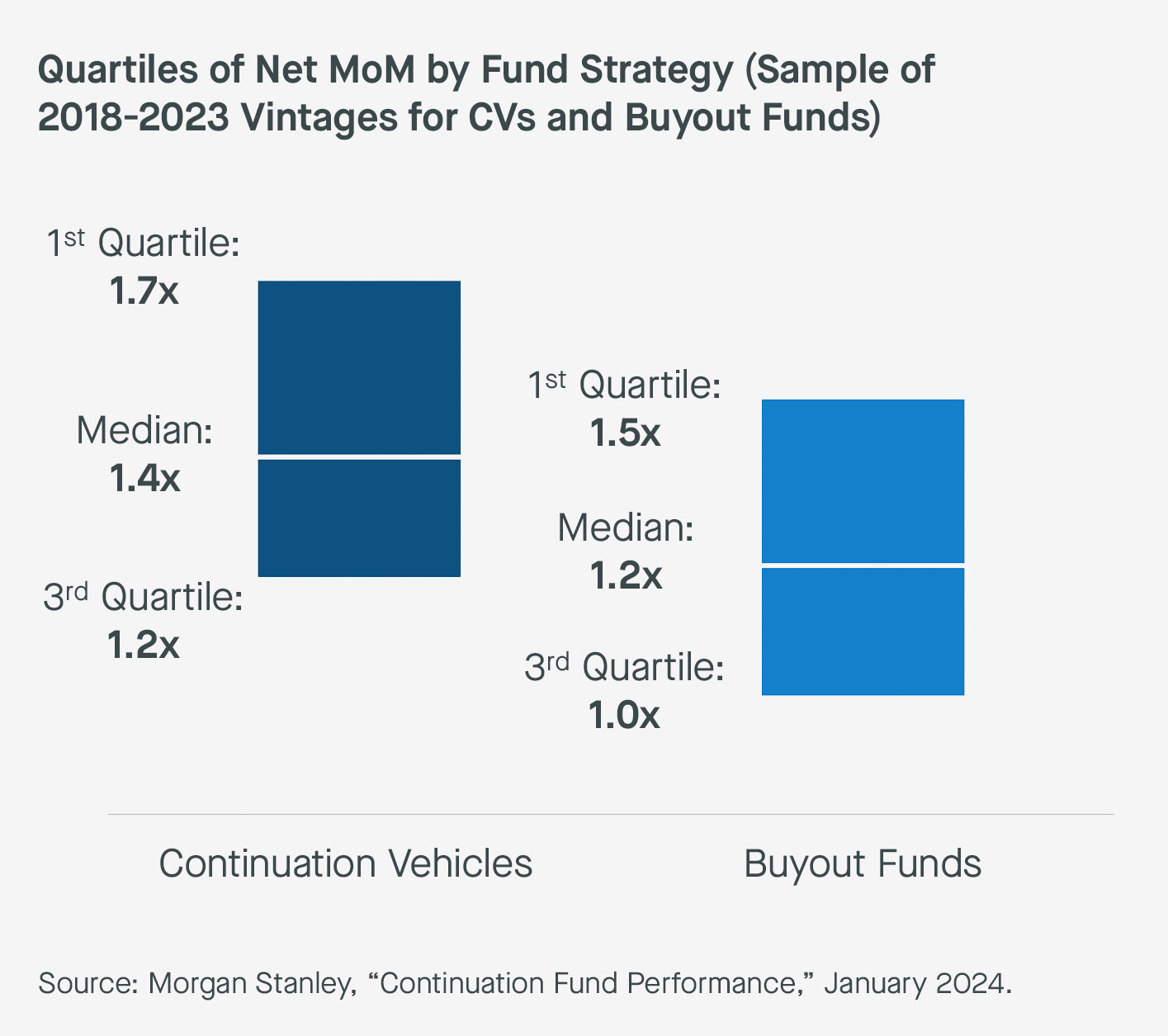

From our experience, sponsors are consistently selecting their best assets to roll into single-asset CVs precisely because they expect to realize further upside. To this end, the performance of CVs has been ~0.2-0.3x stronger in terms of MoM relative to buyout funds across the first, median, and third quartiles from 2018-23 (see Exhibit 3). This gap reflects the positive selection bias inherent in single-asset CVs, where a sponsor is actively choosing to extend their hold period and, in many instances, increase their investment.

In fact, the sponsors we’ve worked with have, on average, reinvested more than 100% of their sale proceeds from our purchases (i.e., added additional equity) into the single-asset CV.

Importantly, the sponsors that are typically utilizing the single-asset CV market often could have sold the asset rather than moving it into a CV. One of the benefits of working alongside sector teams that are executing primary private equity transactions is having confidence that there are both strategic and financial buyers interested in acquiring a company engaging in a CV transaction.

Exhibit 3: GP-Leds Benefit From Positive Selection Bias

The single-asset CV market should not provide an exit route to companies that can't otherwise be sold—i.e., it should not provide a life preserver; rather, the market is generally comprised of companies that can be sold in a difficult exit environment precisely because they’re widely valued as trophy assets.

We believe the strong desire of sponsors to own their best companies for longer will continue to be the primary driver of the single-asset CV market. This market dynamic, where sponsors provide a steady supply of deals, is one that we feel will persist and grow with limited sensitivity to broader public market conditions in the years ahead.

Strong Fundamentals And Long-Term Tailwinds Support The Single-Asset CV Market

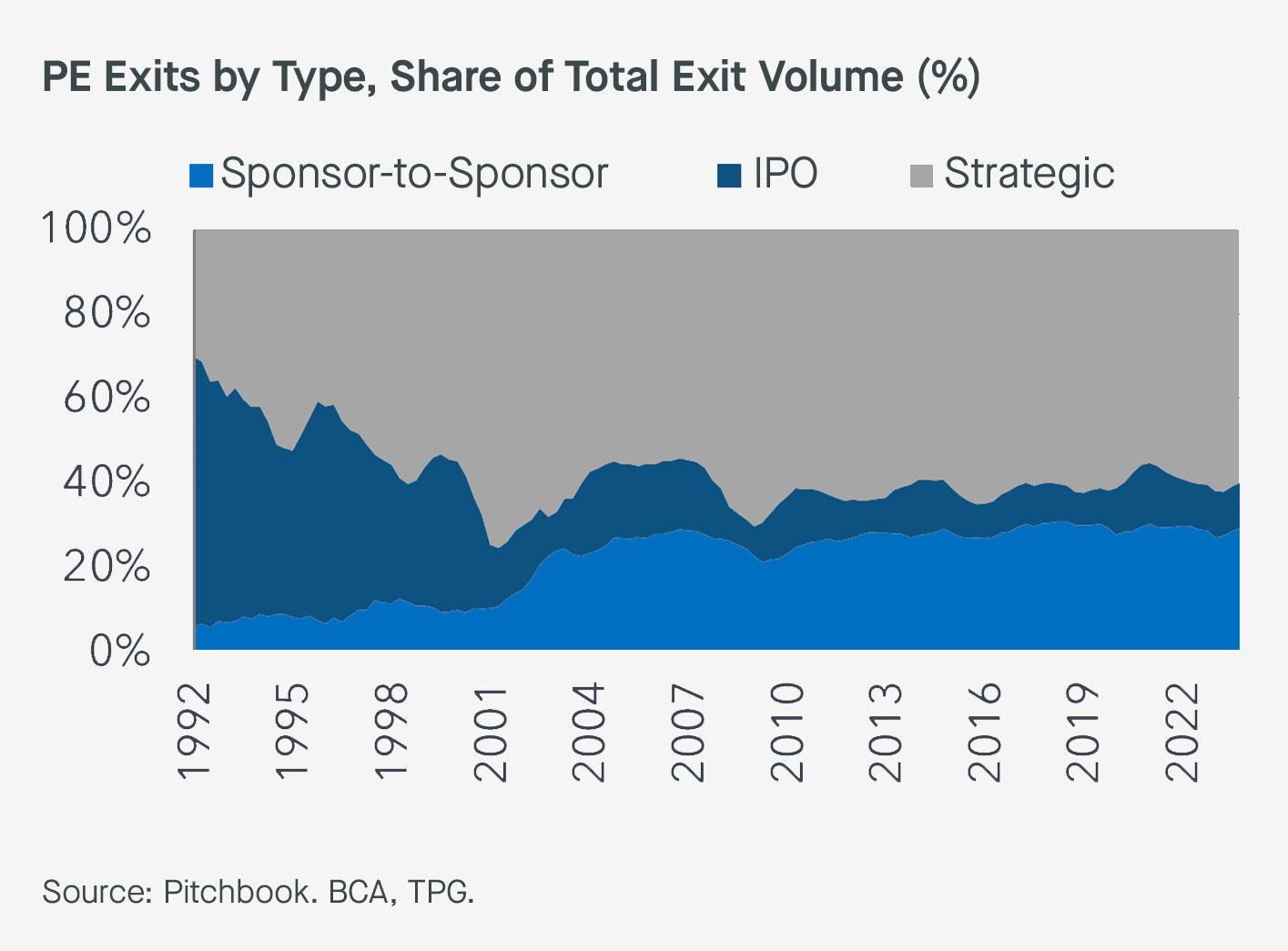

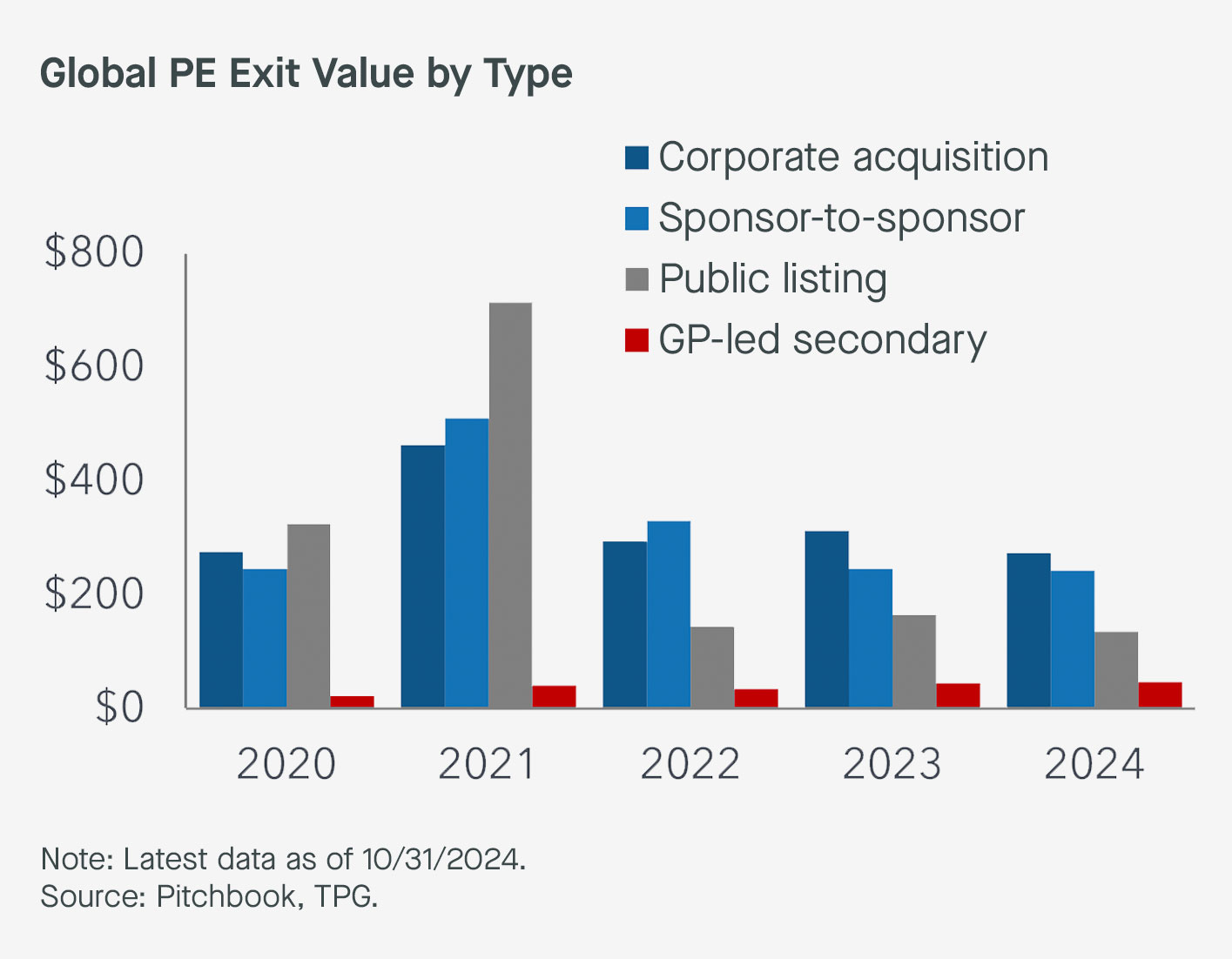

The rapid growth of single-asset CVs coincides with a broader secular trend towards the increased use of sponsor-to-sponsor exits across private equity (see Exhibit 4). Such exits have grown from around 5% of total exit volume to almost 20% over the past few decades.

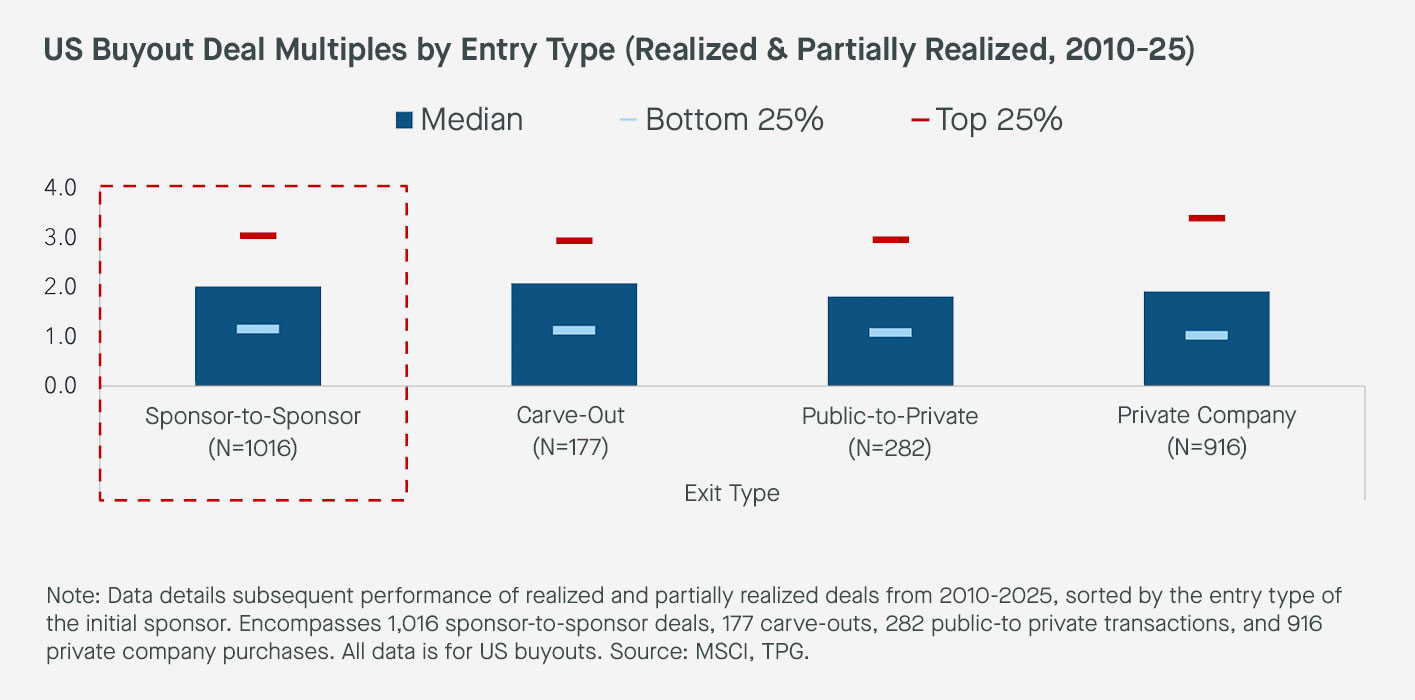

Despite sponsor-to-sponsor transactions representing a second cycle of PE ownership of the same company, they’ve consistently generated performance in line with primary buyouts (where a company is owned by PE for the first time—see Exhibit 5). We believe the single-asset CV market is predominately accessing deals from the sponsor-to-sponsor market and is well positioned to access a slice of the best-quality assets from this deal flow, given the economic incentives for GPs to move their best assets into a CV.

Today, as GPs consider which companies they might sell to a competitor, we believe they will increasingly keep the best one for themselves by partnering with a single-asset GP-led secondaries fund.

Exhibit 4: Sponsor-to-Sponsor Deals Have Grown Steadily As Share Of Total PE Exits

Exhibit 5: Sponsor-to-Sponsor Deal Performance Compares Favorably Relative To Other Deal Entry Types Once They’re Realized. We Believe GP-Led CVs Will Capture The Top Slice Of This Market.

The strong and persistent incentive for GPs to pursue single-asset CV transactions has dovetailed with a growing acceptance of these transactions among the LP community—particularly given the widespread adoption of accepted market standards on how single-asset GP-led secondaries processes are run.

As more and more GPs complete their first single-asset CV, awareness and adoption of the transaction structure is likely to continue to grow, driving further penetration across the private equity market. As the high quality of the deal flow has become apparent, new buyers have also been attracted to the market. We view this as a positive development.

The entrance of new secondary buyers, with company underwriting and sector expertise, should help to accelerate market growth—supplying additional capital to an under-capitalized market and providing both LPs and sponsors with the confidence that lead secondary buyers have the ability and expertise to lead and underwrite single-asset deals.

A Different Approach To Single-Asset CVs:

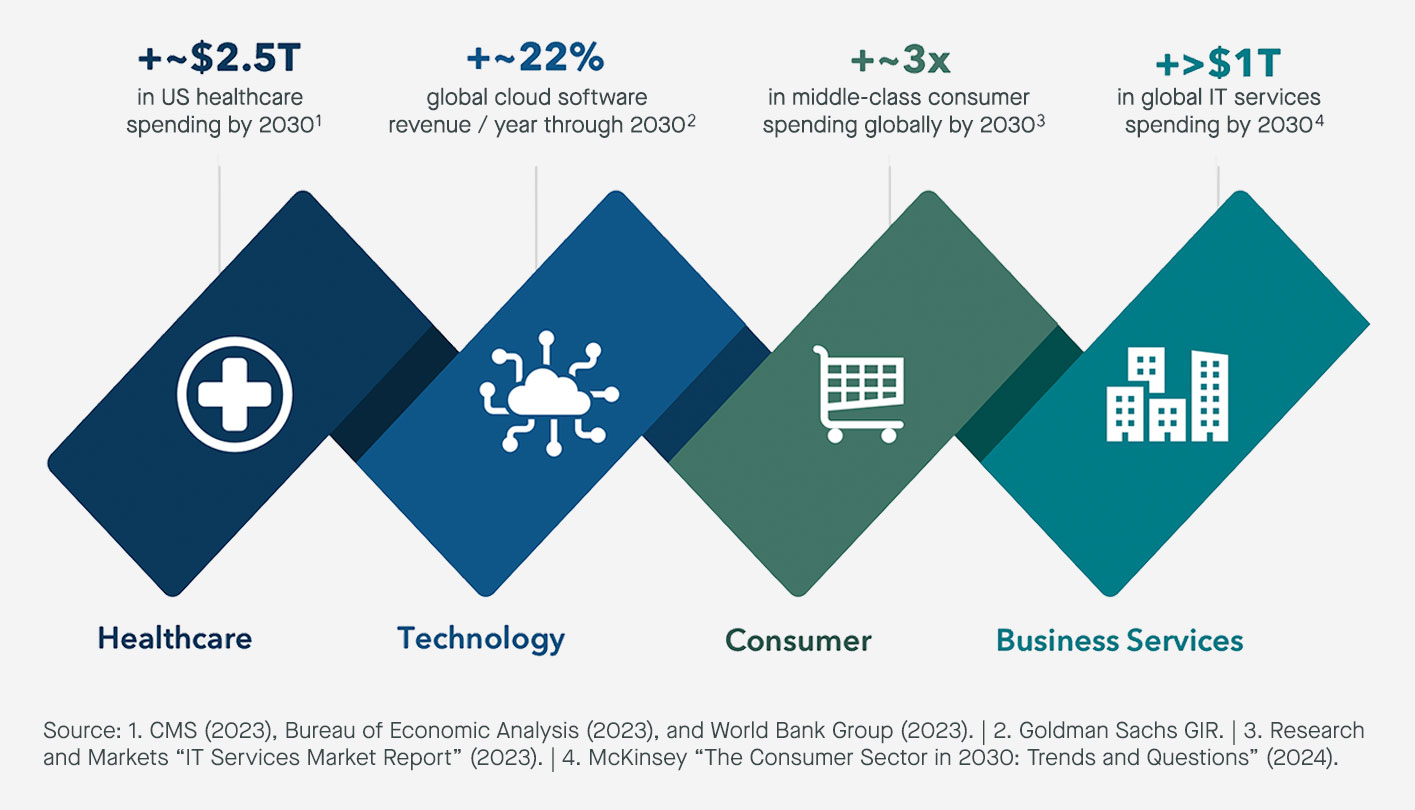

Single-asset CV deals are investments in individual companies. In our view, investment success therefore depends upon making effective judgments about the sector, business differentiation, management team, and sponsor partner of a company. This requires a skillset that’s much closer to direct private equity investing, where having the tools and experience to diligence assets and deep sector knowledge and expertise is critical (see Exhibit 6).

For this reason, we believe single-asset CV investors who take a sector-driven, asset-first approach, have a unique advantage in terms of their ability to source unique transactions and select assets with greater upside potential.

Exhibit 6: We Believe Sector Expertise And A Focus On Dynamic Sectors, Such As Healthcare, Technology, Consumer, And Business Services, Will Be A Differentiator For Single-Asset CV Investors As This Market Continues To Evolve And Grow

Single-Asset CVs: The Road Ahead

In coming years, we expect strong continued growth in the private equity secondaries market and demand for single-asset CVs, in particular. GP-led secondaries delivered a record year in 2024, with total exit value of around $70B. That said, we believe the market remains highly undercapitalized relative to the overall opportunity.

Despite increased secondaries fundraising, the growth in GP-led deal volume has only just kept pace with growth in unrealized private equity value. At the current pace of growth in unrealized private equity value, GP-led volumes could more than double by 2028 while still remaining less than 2% of the total market (see Exhibit 7).

Exhibit 7: The GP-Led Secondaries Market Would Be Highly Undercapitalized Even If Volumes Double by 2028

Given this backdrop, we believe the rise of the single-asset specialist is only in the early innings and will help unlock the full potential of this market. This should further solidify the role that single-asset CVs can play in terms of providing a consistent, reliable exit alternative to more traditional exit options (see Exhibit 8).

Exhibit 8: GP-Led Secondaries Are Evolving To Become A More Reliable Exit Alternative

Conclusion:

A possible improvement in the exit environment in coming years could present an important inflection point for the broader private equity secondaries market. We believe the drivers of the single-asset CV market will continue to strengthen, largely irrespective of the general exit environment. As the market matures, and the shift towards greater specialization continues, we expect the single-asset CV market to thrive.

Sponsors’ desire to capture additional upside from their most prized assets is likely to continue unabated. With growing acceptance of these transactions, and the entrance of new firms designed to bring private equity and sector expertise into the secondaries market for the first time, a combination of both increased supply and demand should cause transacted volume to increase materially.

We believe this market will continue to evolve rapidly with increased levels of sophistication over the next 5-10 years. It will no longer be sufficient to rely simply upon a “discount to NAV” and sponsor quality to guide investment decision-making—LPs will demand that secondaries investors have expertise in the sectors where they are investing, truly understand the businesses that they are evaluating, and have the requisite underwriting skills to justify making large investments in individual companies.

Looking ahead, we believe single-asset GP-led secondaries managers with specialization, sector depth, and an extensive private equity toolkit will have a distinct and durable competitive advantage in the single-asset CV market. This will benefit both the investors in single-asset secondary funds, as well as the sponsors who are rolling assets into CVs.

Disclosures

This white paper is provided for educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The contents hereof should not be construed as investment, legal, tax or other advice.

This white paper, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of TPG Global, LLC (together with its affiliates, “TPG”).

Certain of the information contained herein, particularly in respect of market data, economic and other trends, forecasts and performance data, is from third-party sources. While TPG believes such sources to be reliable, TPG has not undertaken any independent review of such information.

Unless otherwise noted, statements contained in this white paper are based on current expectations, estimates, projections, opinions and beliefs of TPG professionals regarding general market activity, trends and outlook as of the date hereof. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. Neither TPG nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance.

If you believe any content, branding, information or other material incorporated into this white paper has been included in violation of applicable law, agreement, or other restriction, or that any other portion of these materials is otherwise improper, please notify us at compliance@TPG.com.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA