TPG Insights

Climate Investing Update: Separating Signal from Noise

A NEW ERA IS EMERGING

Global Momentum

Over the last decade, energy transition investing was shaped to a large degree by policy and climate priorities. In the next, it will be driven by market forces and a reordering of energy sector economics, with distinct winners and losers. The transition is accelerating rapidly, and momentum is building globally.

“All-of-the-Above” Electricity Addition

This new era will be defined by soaring electricity demand, leading market players to adopt an “all-of-the-above” approach to energy addition, mixing a broad range of electricity generating technologies.

Adaptation & Resilience as an Actionable Investment Theme

Investment in adaptation and resilience will take on growing importance, as adverse climate impacts have only accelerated— underscoring the need to harden infrastructure, safeguard supply chains, and build resilient systems amid a more volatile climate.

Emerging Technologies Mature

Even as policy noise has captured attention, the technologies driving the energy transition have raced ahead—from nuclear to electric aviation—creating massive new investment opportunities in next-gen energy, transportation, and infrastructure.

Since the start of the energy and climate transition investing journey, there’s rarely been such a sharp disconnect between the rapid pace of ongoing technological innovation and progress, on the one hand, and perception about the path ahead, on the other. The noise of the moment has obscured the substantial gains that have already been made and the emerging opportunities on the horizon.

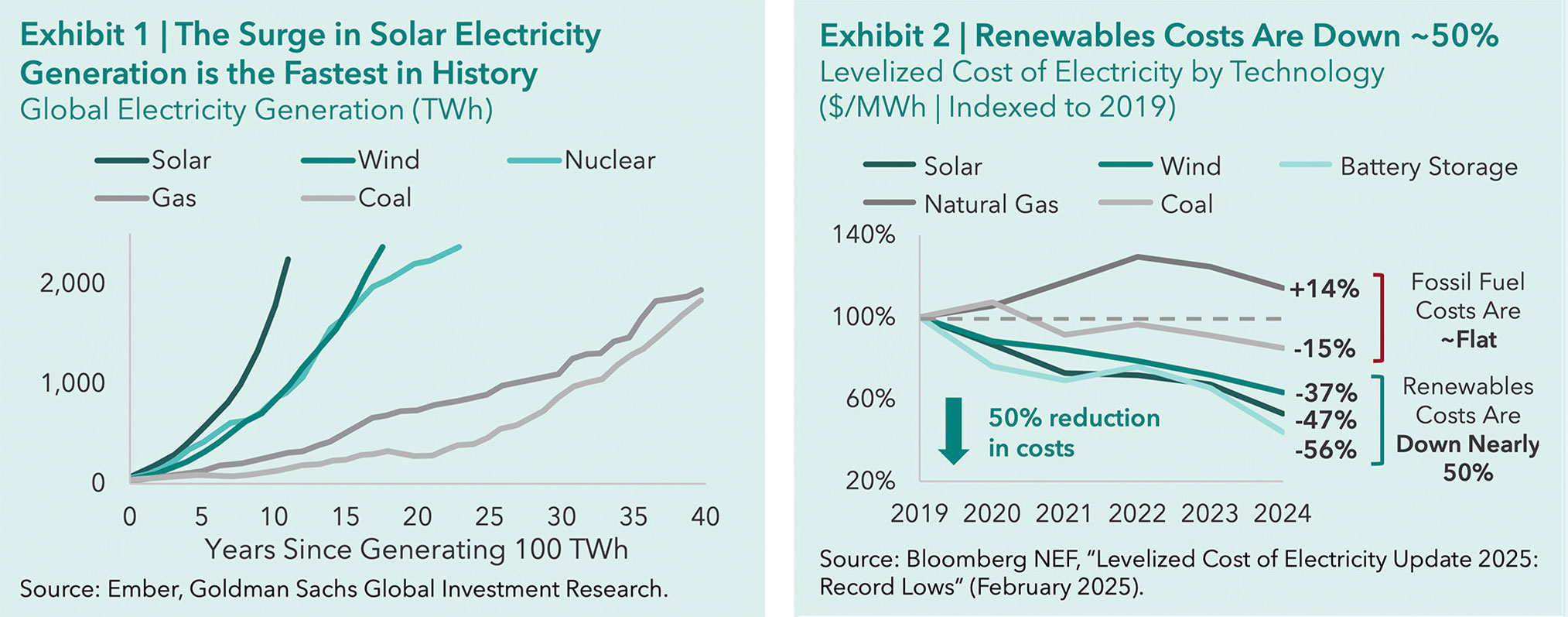

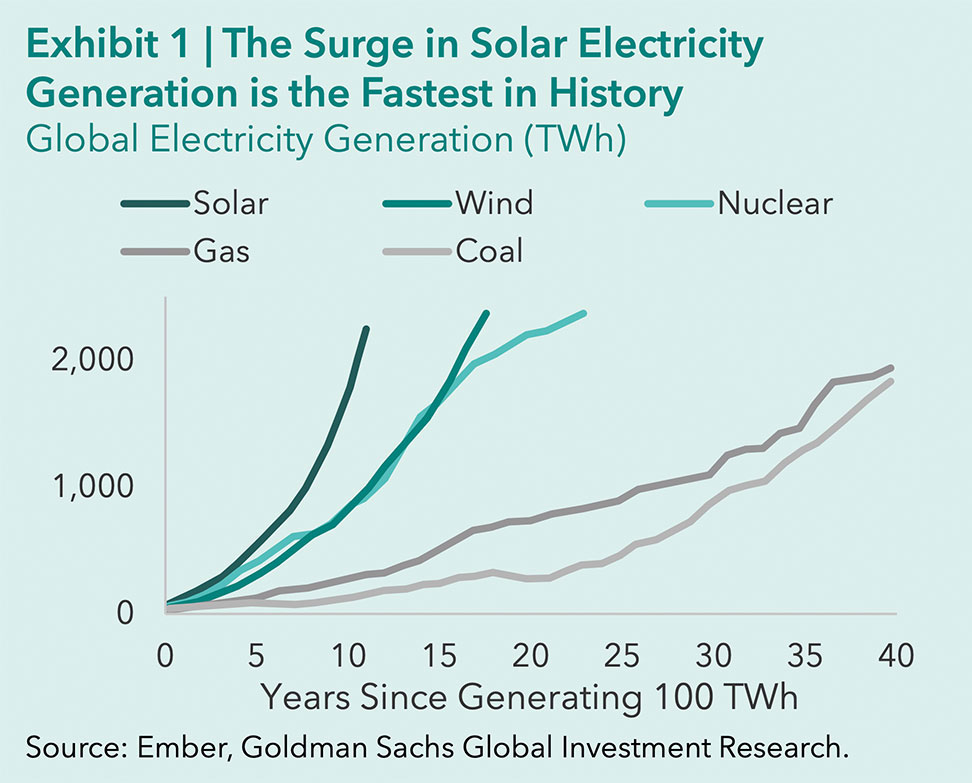

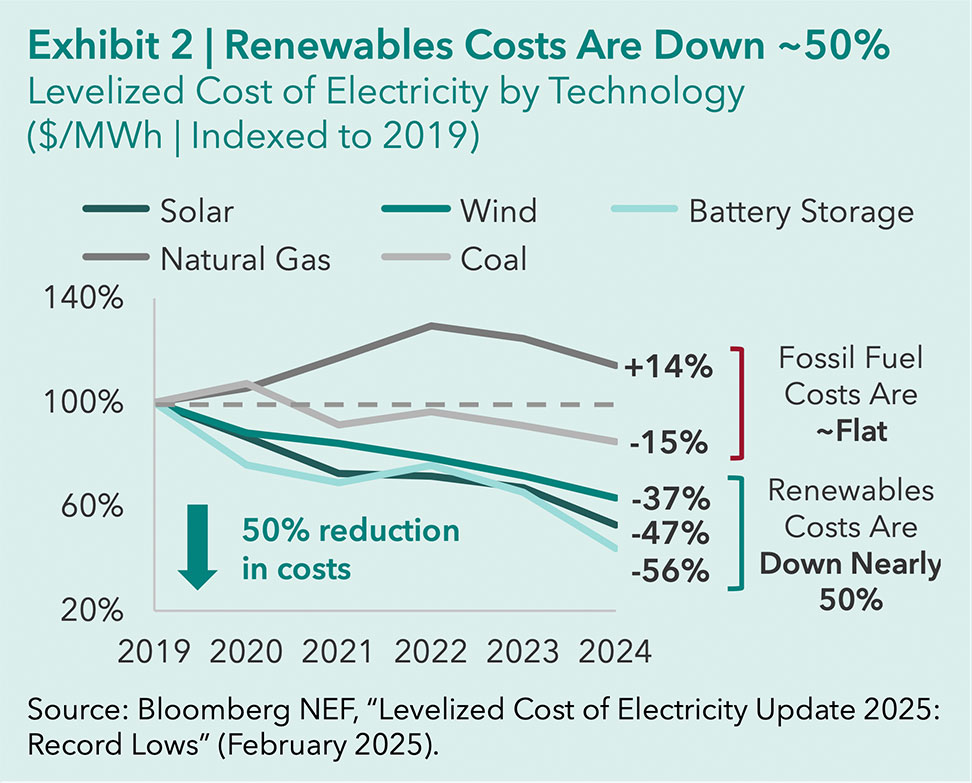

Our role as long-term investors is to tune out this noise and recognize the early patterns and signals pointing to lasting market shifts. Such shifts are evident today, with energy markets currently undergoing a structural transformation, driven by the rapid adoption of solar power, which has outpaced every other source of electricity in history (See Exhibit 1), and by major advances in battery technology that allow solar power to be firmed. This acceleration in the energy transition hasn’t simply been the product of supportive government policy but has been propelled forward by powerful market dynamics (See Exhibit 2)

The result has been significant early strides in the energy transition, marking the beginning of a generational investment theme that will reshape the global economy for decades to come. Looking ahead, the energy and climate transition is entering a new phase, one which will increasingly be shaped by economic fundamentals and technological progress rather than policy support. Powerful fundamental forces are already transforming industries and sectors, creating both winners and losers, and producing a new generation of actionable investment opportunities.

The Signal in the Climate & Energy Transition

The current chapter in the energy transition will be remembered for two events that arrived just months apart. The passage of the Inflation Reduction Act (IRA) in August 2022 represented a milestone in the long arc of government climate initiatives. But it was the release of ChatGPT in November 2022 that marked the real turning point and ignited powerful new market forces, from surging electricity demand to accelerating innovation and capital formation across the energy transition landscape.

Both events left their mark, but it’s ChatGPT—and the competitive AI race it’s unleashed—that will likely be remembered most and drive the market forward in the years ahead. The explosion of generative AI has catalyzed a deluge in electricity demand and intensified the pressure for cleaner, more abundant sources of supply.

Despite a reversal of some of the provisions of the IRA, via the One Big Beautiful Bill Act (OBBBA), government support for most energy transition technologies remains well ahead of the status quo prior to its passage. When we began investing through TPG Rise Climate (“TRC”) in 2021, we didn’t anticipate the magnitude of policy support that would emerge in the US in the form of both tax credits and subsidies for the energy and climate transition. The IRA therefore came as somewhat of a positive upside surprise but one that we’ve never felt was essential for sustaining the strong momentum of clean energy innovation.

But among the forces that will shape the next decade of the energy transition, none may rival the demand surge triggered in part by AI, which we believe will transform energy and electricity markets more profoundly than policy ever could. The scale of the surge is staggering—and almost unimaginable just a few years ago—with electricity demand growth expected to rise twelve-fold over 2025-35 relative to the prior decade, fueled by AI’s explosive power needs and global competition to lead the next technological era.

An estimated $2T in spending on power supply and the grid will be required in the US alone to meet this surge in demand, according to Goldman Sachs Global Investment Research. That’s more than twice the amount of tax credits and grants from the IRA, much of which will continue to flow to the private sector even after the cuts made by the OBBBA (See Exhibit 3).

With greater clarity on where US policy is settling, and the extraordinary investment needs required for energy addition to meet surging electricity demand coming more sharply into focus, the signal for the next decade in the energy transition is now well defined— expanding opportunity, deepening complexity, and an increasingly global stage for investment.

Download the full report hereDisclosures

This white paper is provided for educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The contents hereof should not be construed as investment, legal, tax or other advice.

This white paper, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of TPG Global, LLC (together with its affiliates, “TPG”).

Certain of the information contained herein, particularly in respect of market data, economic and other trends, forecasts and performance data, is from third-party sources. While TPG believes such sources to be reliable, TPG has not undertaken any independent review of such information.

Unless otherwise noted, statements contained in this white paper are based on current expectations, estimates, projections, opinions and beliefs of TPG professionals regarding general market activity, trends and outlook as of the date hereof. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. Neither TPG nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance.

If you believe any content, branding, information or other material incorporated into this white paper has been included in violation of applicable law, agreement, or other restriction, or that any other portion of these materials is otherwise improper, please notify us at compliance@TPG.com.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA